14 an hour is how much a year 2022 (Is it feasible to live on it?)

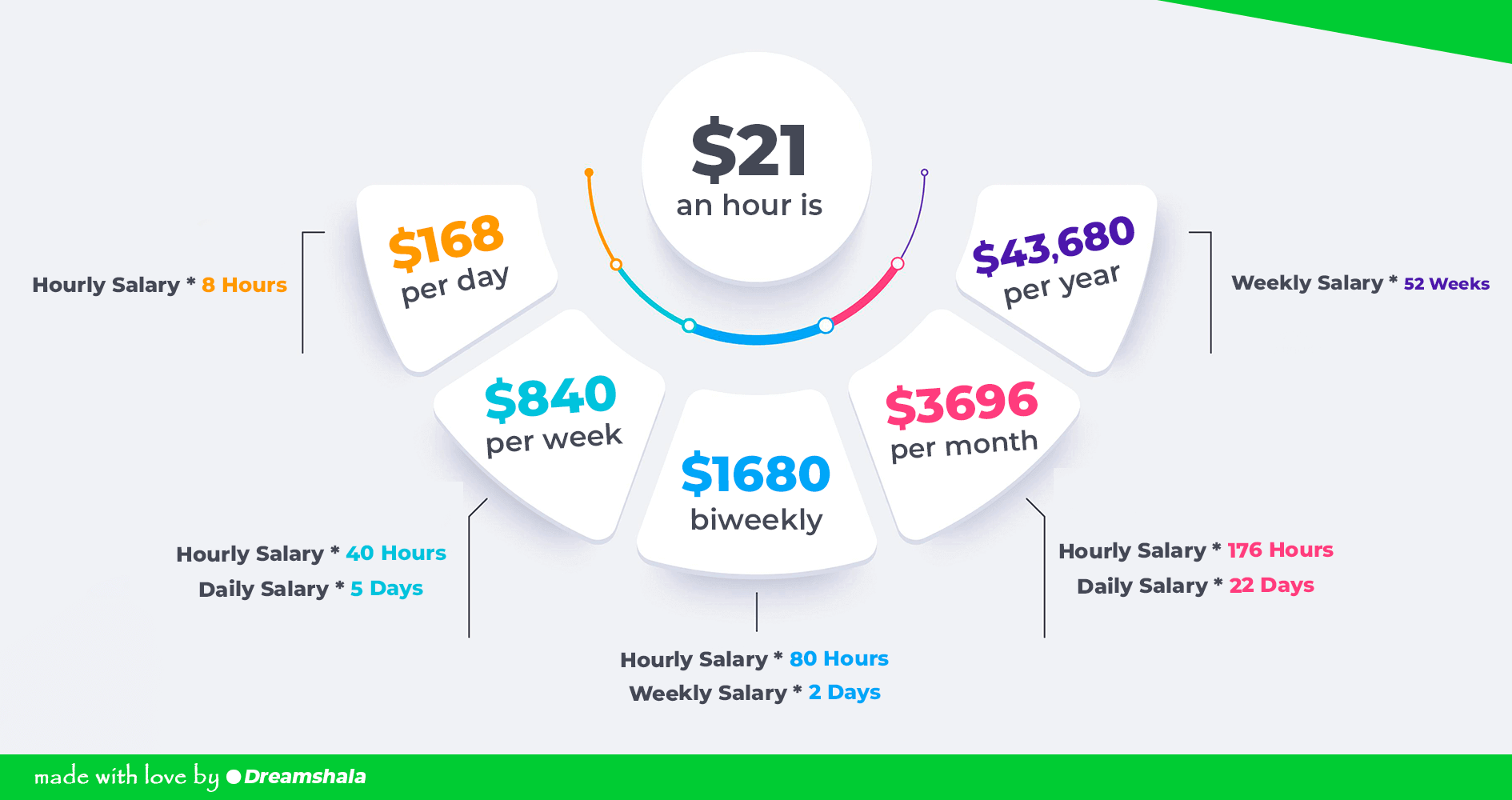

If you want to calculate the weekly wage you need to calculate the hourly wage by the number of working hours in a week. So in this case annual salary is equal to: $21 × 40 × 50 = 840 × 50 = $42000. Weekly wage is equal to: $21 × 40 = $840.

Top 10 is 25 an hour good That Will Change Your Life Nhôm kính Nam Phát

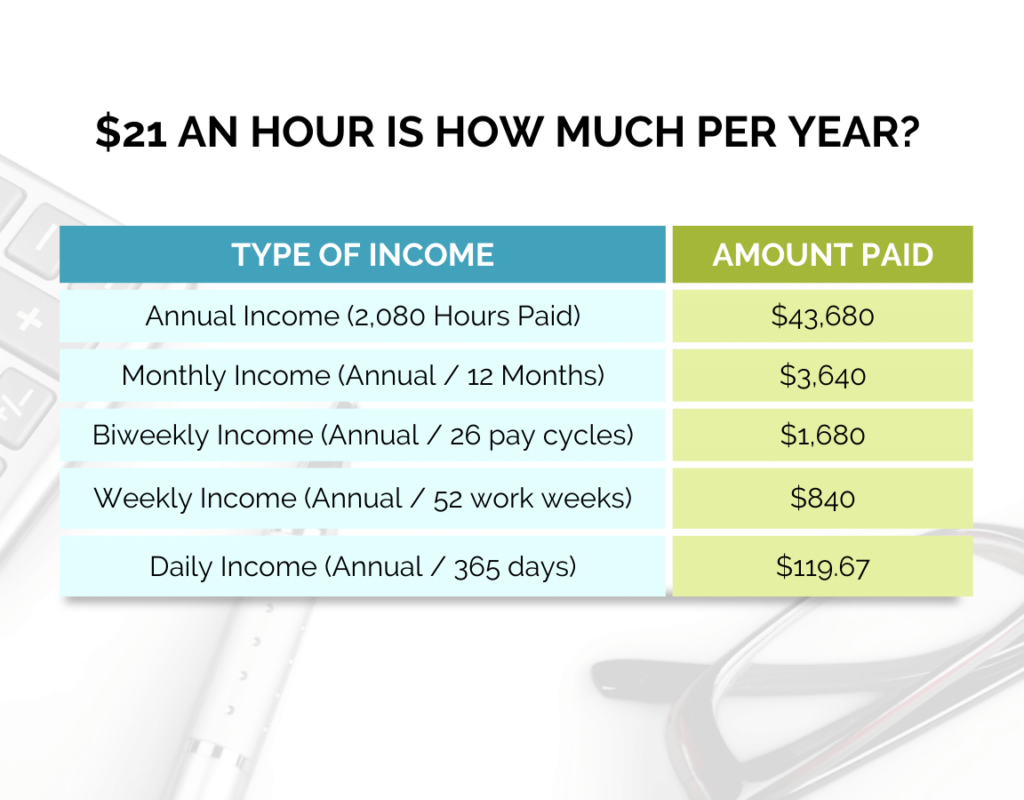

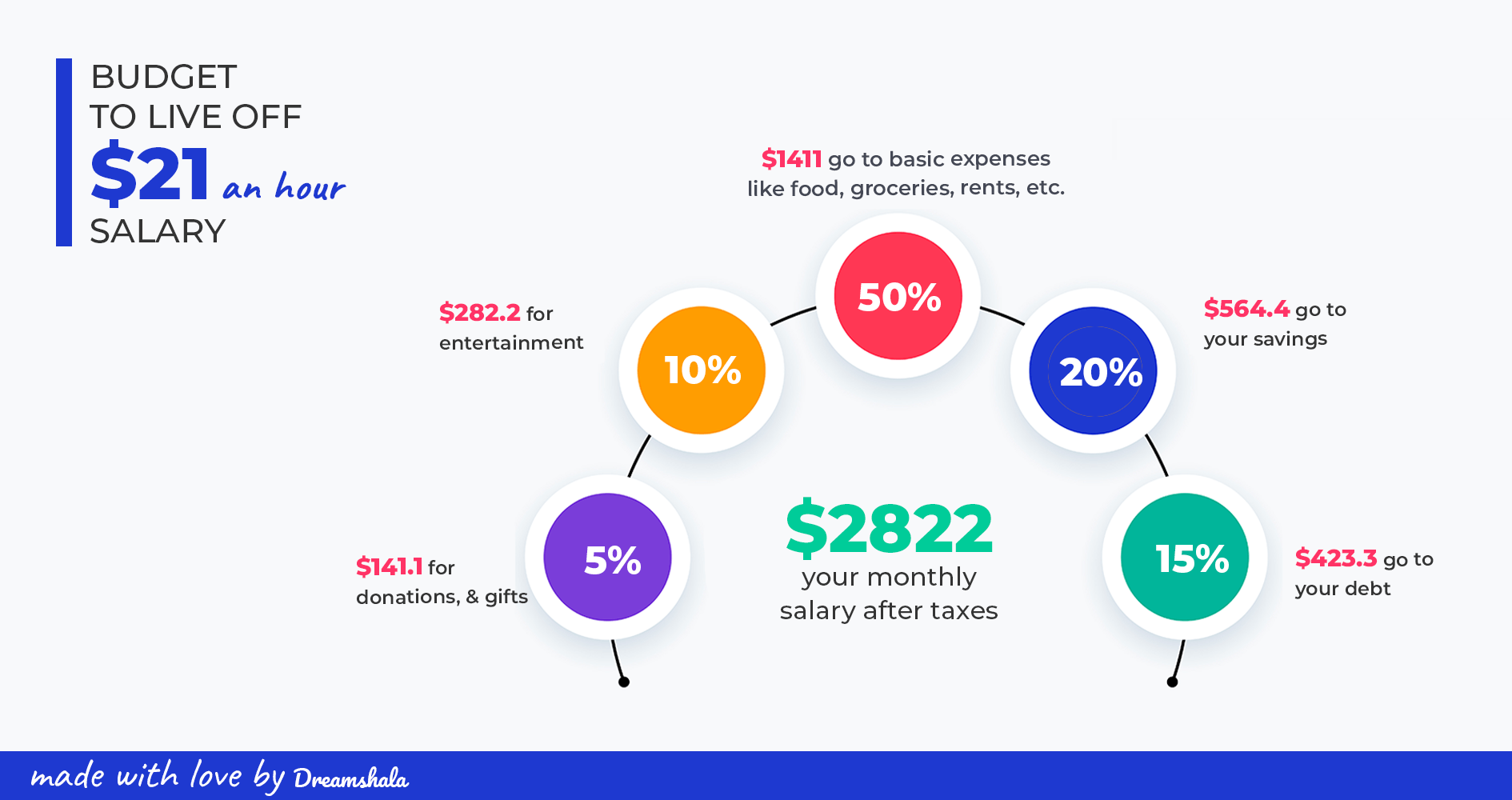

With $21 per hour and an annual salary of $43,680 before taxes, you can expect a gross bi-weekly wage of $1,680, or $1,256 net. And your monthly gross income will be $3,360. After taxes, your funds per month will be around $2,512. Remember, if you're paid an hourly rate rather than a fixed salary, you are subject to overtime laws.

10 Best Images of Hour Conversion Chart Minute Decimal Hours

Frequently Asked Questions. $21 an hour is how much a year? If you make $21 an hour, your yearly salary would be $43,680. Assuming that you work 40 hours per week, we calculated this number by taking into consideration your hourly rate ( $21 an hour ), the number of hours you work per week ( 40 hours ), the number of weeks per year ( 52 weeks.

21 an Hour is How Much a Year? How To FIRE

Yearly Working Hours: A standard full-time job typically assumes 40 hours per week. There are 52 weeks in a year, so the total working hours in a year are 40 hours/week × 52 weeks/year = 2,080 hours/year. Working Days in a Year: A common approach is to assume 5 working days in a week. So, the total working days in a year are 5 days/week × 52.

Units of Time in English English Study Page

21 dollars per hour working 2,000 hours. As a simple baseline calculation, let's say you take 2 weeks off each year as unpaid vacation time. Then you would be working 50 weeks of the year, and if you work a typical 40 hours a week, you have a total of 2,000 hours of work each year. In this case, you can quickly compute the annual salary by.

20 an Hour is How Much a Year? (Monthly Budget Guide for 2023)

The simple answer is that $21 an hour is about $43,680 per year in pretax dollars. This assumes that you work 40 hours a week, every week. If they are strict 40-hour weeks, the total amount may be about a few thousand dollars shy of this number (as we explain in further detail below). Your take-home pay (after taxes and deductions) will depend.

How Many Work Hours in a Year? All the Key Details You Need

It depends on how many hours you work, but assuming a 40 hour work week, and working 50 weeks a year, then a $21 hourly wage is about $42,000 per year, or $3,500 a month. Is $21 an hour good pay? It's a little below average. We estimate that only 46% of workers in the United States earn less than $21/hour.

31 An Hour How Much A Year? New

To convert your annual salary to hourly wage, follow these steps: Determine the number of hours you work per week. The standard value is 40. Multiply it by the number of weeks in a year, i.e., by 52. You've found the number of hours you work per year. Divide your annual salary by the result of Step 2.. The result is your hourly wage.

16.25 An Hour Is How Much A Year? Hourly To Annual Salary

To decide your hourly salary, divide your annual income with 2,080. Assuming you make a hundred thousand dollars in 12 months, your hourly wage is $100,000 / 2080, or $48.07. If you worked 37.5 hours a week, divide your annual salary by 1,950 (37.5 × 52). At $100,000, your hourly salary is $100,000 / 1,950, or $51.28.

21 An Hour Is How Much A Year? Tips & Tricks To Live On It Radical FIRE

$21 an hour is how much annually? $21 per hour is $43,680 a year.This number is based on 40 hours of work per week and assuming it's a full-time job (8 hours per day) with vacation time paid. If you get paid bi-weekly (once every two weeks) your gross paycheck will be $1,680. To calculate hourly wage to yearly salary we use this formula: Hourly wage * 40 hours per week * 52 weeks.

21 An Hour Is How Much A Year? (Good Salary or Not?)

Earning $21 per n hour results in a annual income of $43,829.1. How to calculate annual salary? First, determine the number of hours you work per week. If you work full-time ( 40 hours a week ), that's 2,080 hours in a year (based on a typical 52-week year). Then, just multiply your hourly rate of $21 by the number of hours worked in a year.

21 an Hour Is How Much a Year? SpendMeNot

If you make $15 per hour and are paid for working 40 hours per week for 52 weeks per year, your annual salary (pre-tax) will be 15 × 40 × 52 = $31,200. Using this formula, we can calculate the following annual incomes from basic hourly pay. It's important to remember that these figures are pre-tax and deductions.

21 An Hour Is How Much A Year? (Good Salary or Not?)

With a salary of $21 per hour, assuming a full-time work schedule of 40 hours per week and 52 weeks in a year, your annual gross income would amount to $43,680 ($21/hour x 40 hours/week x 52 weeks). Following the guideline of 10% to 15%, your annual car-related expenses should ideally range between $4,368 and $6,552.

42000 a Year is How Much an Hour? Good Salary to Live On? Hanover

Annual salary to hourly wage. ($50000 per year / 52 weeks) / 40 hours per week = $24.04 per hour. Monthly wage to hourly wage. ($5000 per month × 12 / 52 weeks) / 40 hours per week = $28.85. Weekly paycheck to hourly rate. $1500 per week / 40 hours per week = $37.50 per hour. Daily wage to hourly rate.

Hourly rate equivalent to yearly salary DominicTeresa

Assuming you work 40 hours a week, 52 weeks a year (that's thousands of hours), your hourly wage of $21 dollars an hour over 2,080 annual hours would amount to an annual salary of $43,680 before taxes. $21 An Hour - Annually. $43,680. Assuming a 40-hour work week, and 52 weeks in a year, a person working for $21 an hour would make $43,680 a.

17.50 an Hour is How Much a Year? Complete Salary Guide

If you make $21 an hour, you would take home $32,760 a year after taxes. Your pre-tax salary was $43,680. But after paying 25% in taxes, your after-tax salary would be $32,760 a year. The amount you pay in taxes depends on many different factors. But assuming a 25% to 30% tax rate is reasonable.